Surpls lines xpress – agencyHelping surplus lines agents stay compliant across states

UI UX RESEARCH– 2021introductionSLXpress

Surplus lines insurance is regulated at the state level. Each state requires agents to file reports, pay taxes, and maintain compliance through its own system. For agents operating across multiple states, staying compliant becomes an ongoing operational challenge.

If successful, Surplus Line Xpress could reduce risk and overhead by simplifying how compliance is managed—while giving surplus lines associations clearer visibility into agent activity across jurisdictions.

2016 – 2017 lead product designeroverviewHighly regulated compliance.

The challenge sits between agents and state surplus lines associations. Agents must access multiple state portals to file and confirm compliance. Associations must track whether that compliance is actually happening.`

These systems were built independently. Each one has its own login, password rules, and data format. As a result, access and visibility are fragmented before compliance work even begins.

THE ASK“

How might we create a single tool that helps agents stay compliant across states—reducing access friction—while giving surplus lines associations a clear, consolidated view of compliance activity?

problemAgents working across states had to juggle multiple portals, credentials, and reporting timelines. Access issues—forgotten passwords, resets, and lockouts—regularly delayed work. Even when filings were completed, tracking compliance across systems required manual effort and constant verification.

HYPOTHESISIf agents could view high-level compliance status for multiple states through one system—without managing multiple credentials—they would stay current more consistently and with less effort.

I believed access was the root problem. If agents could reliably get in and see where they stood, compliance would follow naturally.

Research The focus was on understanding how access, reporting, and oversight intersected in daily work.

-

Studied how agents accessed state portals, reset passwords, and confirmed filings across systems.

-

Identified opportunities to consolidate visibility without disrupting state-specific requirements.

InsightsUnderstanding that turbo machinery installations differ from facility to facility was a clear signal that I needed to design the task-completion workflow with the up-most flexibility.

♔

“I spend too much time resetting passwords just to file reports.”

♔

“I don’t know if I’m fully caught up unless I check each portal.”

♔

“Every state has different login rules—I can’t keep them straight.”

♔

“There’s no single place to see the full picture.”

♔

“Sometimes my reporting doesn’t match or is delayed because I can’t even get into the system.”

PrinciplesReduce access friction first. If agents can’t get in, nothing else matters.

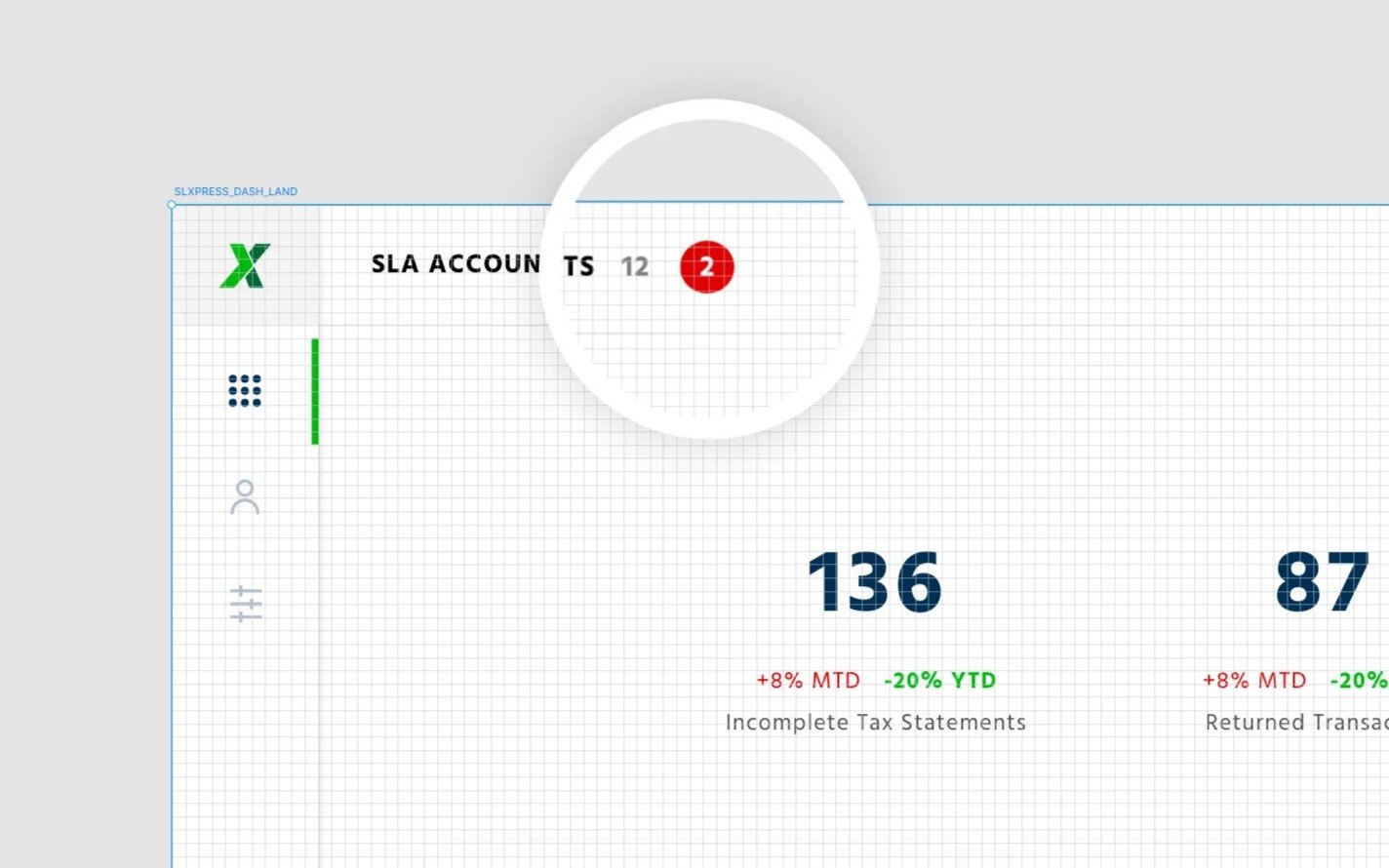

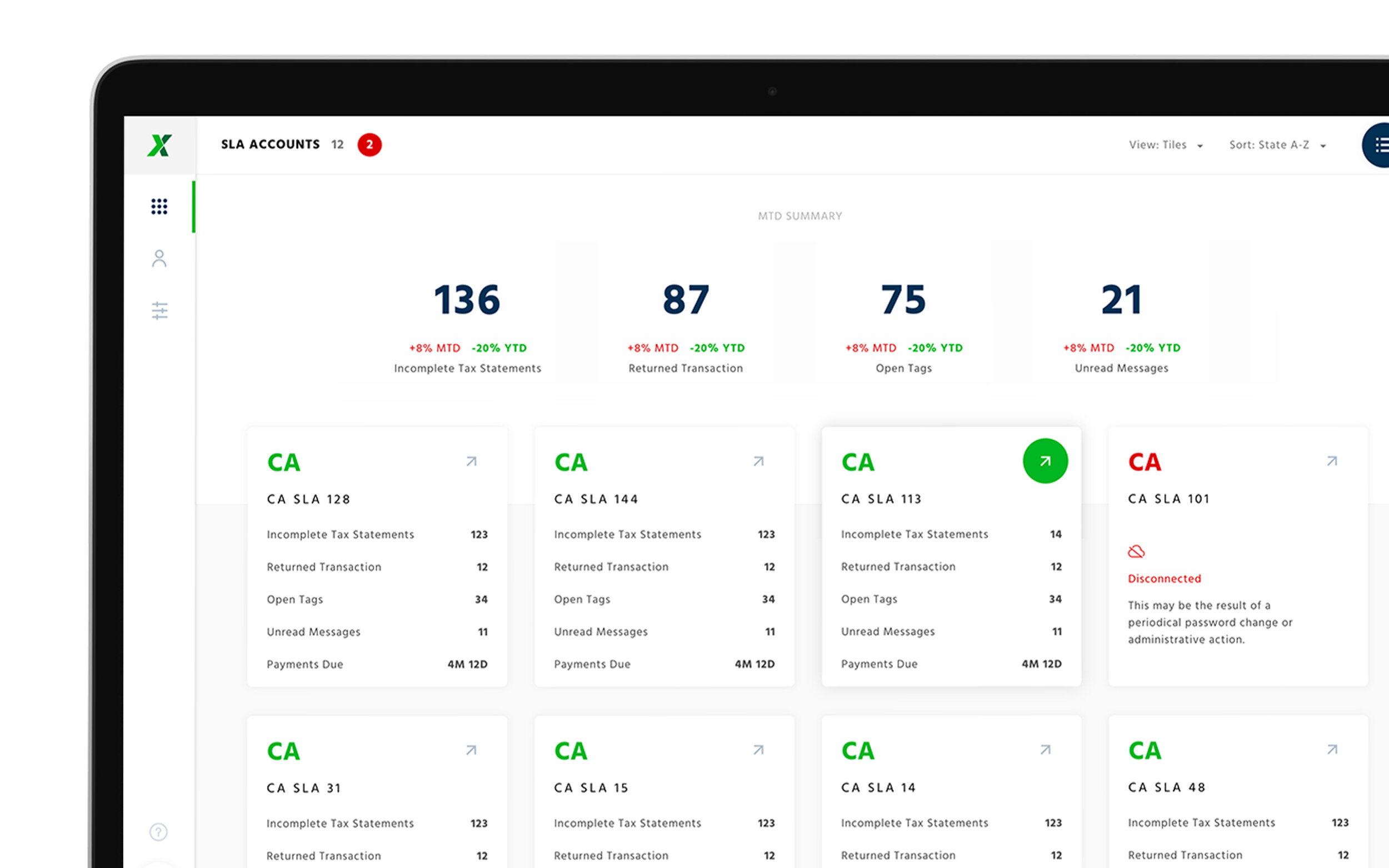

Make status obvious. Compliance standing should be clear at a glance.

Support oversight, not enforcement. Enable early visibility instead of reactive follow-up.

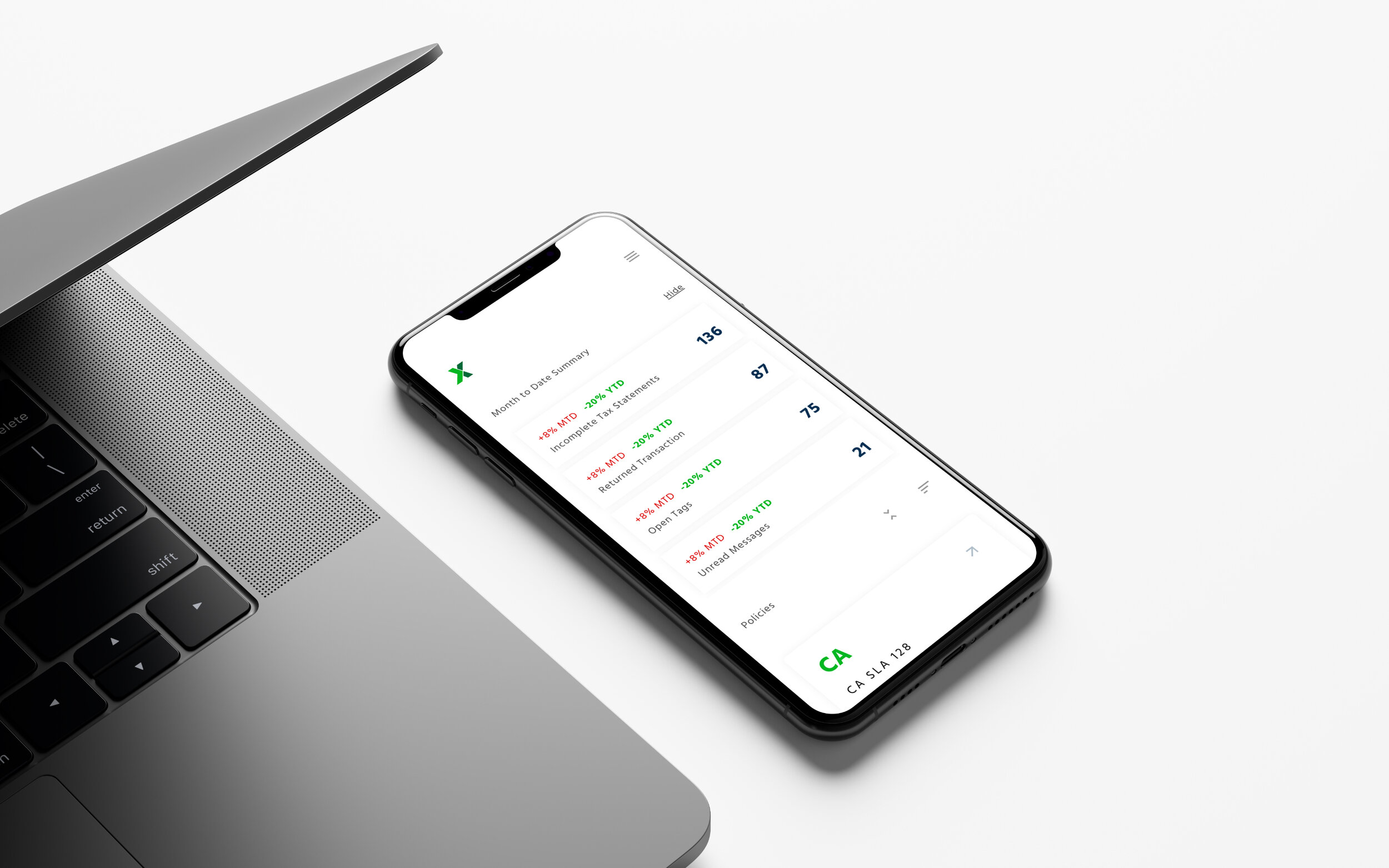

Unified compliance dashboardAgents could view filing status, deadlines, and high-level data across states in one place.

Single access pointOne login surfaced data from multiple state systems, eliminating password fatigue and reset loops.

Shared visibility for associationsAssociations gained a consolidated view of compliance without manual verification.

OUTCOMES

Agents spent less time managing logins and more time completing filings. Fewer access issues led to fewer delays and missed deadlines.

Associations gained earlier visibility into compliance gaps, reducing reactive enforcement and follow-up.

Operationally, the system reduced uncertainty and duplication across both sides of the workflow.

Strategically, Surplus Line Xpress created a scalable foundation for multi-state compliance—supporting growth without increasing administrative risk.